In the coming year, as health systems, hospitals, and physicians continue to deal with the financial and operational repercussions of the COVID-19 pandemic, ECG expects to see increased consolidation by way of mergers and acquisitions (M&A) among independent providers and health systems alike.

- Compounding financial pressures will force independent physicians to seek economies of scale and financial support via partnerships with larger health systems.

- The number of surgical cases moving out of the inpatient setting and into ASCs will grow, which means health systems will need to identify backfill strategies and opportunities to mitigate the margin depression resulting from this shift.

- An increasing number of rural hospitals will face financial hardships and seek partnerships as COVID-19 relief funds begin to expire.

- Nontraditional organizations (e.g., Amazon) will continue serving as market disruptors by making significant investments in the healthcare space like those seen in 2022. The cost to finance growth will increase the likelihood of innovative partnerships as organizations look to share risks and financial burden.

Whether you are an executive at a health system, an independent provider, or an investor, it will be important to understand the drivers behind these market trends and ensure your organization is prepared and poised to act accordingly.

Financial Pressures on Physician Groups

Although originally proposed as a 4.5% reduction, Congress’s final cut to the Medicare Physician Fee Schedule for the coming year was set at 2%.[1]This decrease in physician reimbursement for a growing portion of the patient population will immediately lead to decreased profitability for physician groups that are still trying to bounce back from the effects of the pandemic while navigating an economic landscape already rife with financial difficulties. Aside from impacting physician revenue, the cut threatens patient access to Medicare-participating physicians, as groups will be forced to reevaluate whether they accept Medicare patients they accept in their practice.[2]

Additionally, as in 2022, inflation and supply chain issues will continue to impact the healthcare sector in 2023. Since 2019, healthcare delivery costs have spiked substantially, with labor costs per adjusted hospital discharge growing 25% from 2019 to 2022. Pharmaceuticals, supplies, and service expenses have all grown at least 15% during the same period. Clinical labor costs in particular are expected to remain at high levels in 2023 as the significant shortage in nursing staff persists.[3]

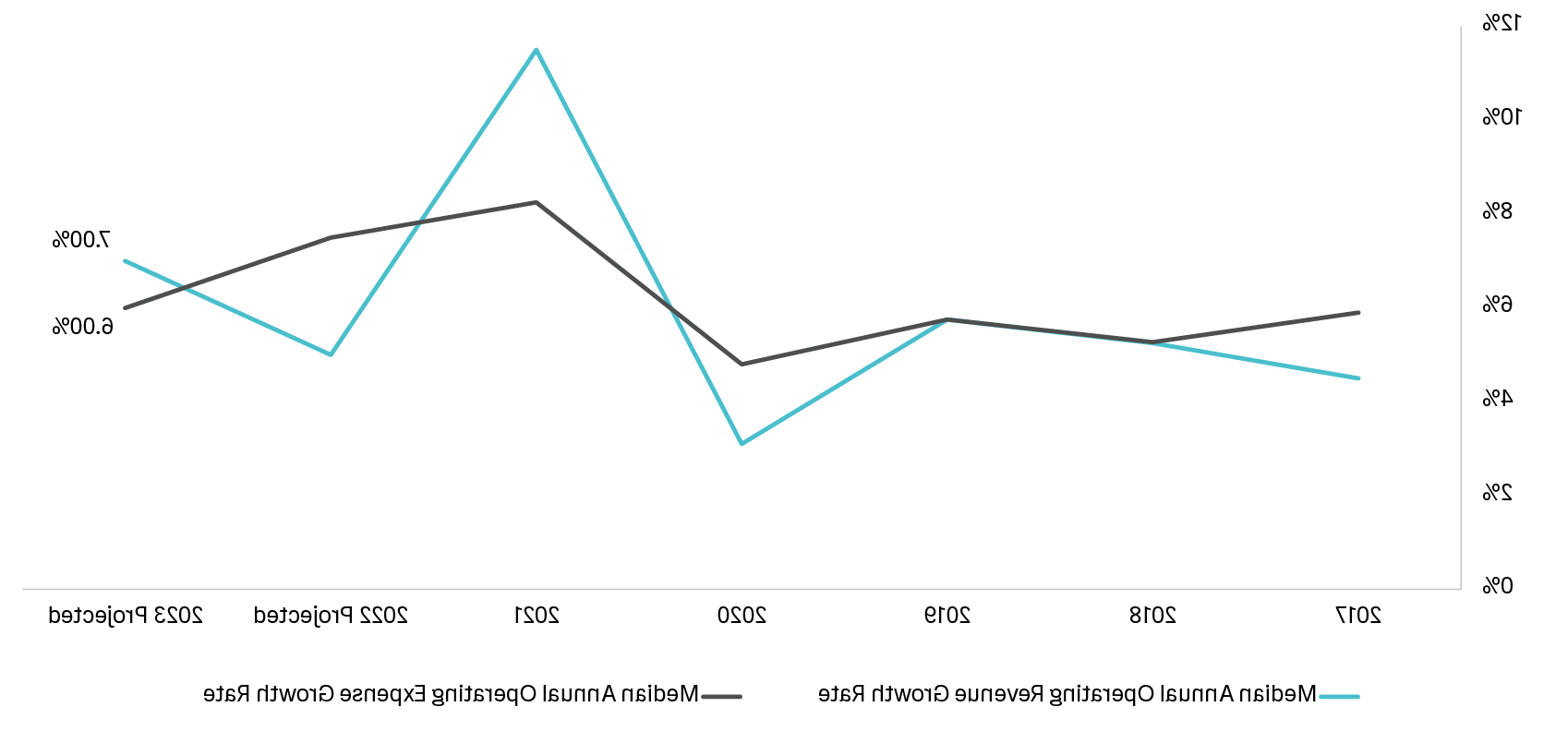

These compounding factors, which impact both top-line revenues and operating expenses, will place added pressure on already compressed margins (shown in figure 1).[4]

As a result of these financial pressures, ECG believes substantial consolidation will occur in the provider market in 2023. As physician pay declines and economic challenges persist, more physician practices will seek alignment with health systems or private equity–backed corporations to stabilize income and operations.

Consolidation in the healthcare space is likely to persist.

Being prepared can help your organization identify the most responsible moment to act before running out of other options.

Read the Full ArticleEdited by: Matt Maslin

Designed by: Mary Anne Akhouzine

Footnotes

- 1.

- 2.

- 3.

- 4.

Published April 26, 2023

You Might Also Like